By Calvin Hexter, Calvin Realty/ Exp Realty

Buying real estate is rarely just a transaction. It’s a decision that affects your finances, your lifestyle, your stress levels, and often the people around you. For some, it represents stability and a sense of home. For others, it’s leverage, opportunity, and long-term wealth creation. Most buyers experience a blend of all three.

What makes buying property challenging isn’t that the process is hidden or overly complicated. It’s that people are asked to make permanent, high-impact decisions in a compressed period of time, often while emotions are elevated and information feels fragmented. Add in market noise, outside opinions, and financial pressure, and it’s easy to see why buyers feel overwhelmed.

This guide exists to slow that process down. Not to remove emotion from it — emotion is part of buying a home — but to anchor decisions in clarity, context, and experience.

This isn’t a checklist to rush through or a quick read meant to push you toward action. It’s a reference. Something you can return to before you buy, while you’re actively searching, and even after possession. The best buyers aren’t just decisive. They’re informed.

Table of Contents

Understanding Why You’re Buying

Before looking at listings, neighbourhoods, or price points, the most important work happens internally. Understanding why you’re buying real estate shapes every decision that follows — often more than buyers realize at the time.

Some buyers are purchasing primarily for lifestyle. They care about commute times, school zones, walkability, access to green space, and how a home feels when they walk through the door. Comfort, flow, and day-to-day usability matter more than spreadsheets.

Others are buying with a strategic lens. They’re thinking about appreciation, rental income, flexibility, future redevelopment, or how the property fits into a broader financial plan. These buyers often tolerate imperfections in exchange for long-term upside.

Neither approach is better than the other. Problems arise when buyers expect one property to perfectly satisfy both goals without compromise. A home that’s ideal for your lifestyle isn’t always a strong investment. A strong investment often requires trade-offs in layout, finishes, or location.

The strongest buying decisions come from being honest about which lens matters most for this purchase — not in theory, but in reality.

Another common mistake buyers make is assuming this purchase needs to satisfy every future version of their life. Very few homes are forever homes. Buying with some flexibility — whether that’s resale appeal, rental potential, or adaptability — reduces pressure and regret.

Even buyers who plan to stay long-term benefit from thinking through an exit strategy. Markets change. Families grow. Careers shift. Optionality has value, even if you never end up using it.

Understanding Your Financial Position Beyond the Pre-Approval

A mortgage pre-approval is a starting point, not a permission slip.

Pre-approvals tell you what a lender is willing to loan, not what will feel comfortable month to month. True affordability includes far more than the mortgage payment. Property taxes, insurance, utilities, maintenance, and long-term repair costs all show up eventually, whether buyers plan for them or not.

Many buyers stretch to the top of their approval range because the payment technically works on paper. What they don’t always account for is how that payment feels once life is layered in — daycare, travel, renovations, rising utility costs, or interest rate adjustments.

Financial stress doesn’t usually appear on possession day. It shows up months later, once the excitement fades and ownership becomes routine.

Another overlooked factor is lifestyle compression. Buying at the edge of affordability often means saying no to things you previously enjoyed — dining out, hobbies, flexibility to travel, or the ability to absorb unexpected expenses. Some buyers are comfortable with that trade-off. Others regret it quickly.

Understanding your true financial position means stress-testing your numbers honestly, not optimistically.

The True Cost of Ownership

Owning a home involves ongoing costs that extend far beyond the purchase price.

Maintenance alone is often underestimated. Roofs, furnaces, hot water tanks, appliances, windows, grading, and exterior upkeep all have timelines, not maybes. Even newer homes carry costs, just on a different schedule.

Utilities fluctuate. Property taxes increase. Insurance premiums adjust. These aren’t surprises — they’re part of ownership.

Buyers who plan for these costs upfront tend to enjoy ownership more and feel fewer financial shocks. Buyers who ignore them often feel blindsided, even though nothing unusual has happened.

Ownership rewards preparation.

Down Payments, Leverage, and Risk

Down payment size and structure influence far more than most buyers realize.

A larger down payment often means lower monthly payments, reduced interest costs, and less exposure to market fluctuations. A smaller down payment preserves cash and increases leverage, which can amplify returns — and risk.

For some buyers, preserving liquidity matters more than minimizing payments. For others, certainty and monthly comfort take priority. There is no universal right answer.

Risk tolerance plays a role here as well. Buyers comfortable with market swings and long-term horizons may structure things differently than buyers who prioritize stability and predictability.

The key is intentionality. Understanding why you’re choosing a specific structure — and what trade-offs it creates — matters more than chasing an arbitrary benchmark.

Understanding the Market You’re Buying In

Real estate markets are local, nuanced, and constantly evolving. Edmonton behaves differently than Calgary. Even within the same city, neighbourhoods can move at very different speeds.

Supply and demand fundamentals matter. Inventory levels, days on market, absorption rates, and pricing trends influence buyer leverage. In some environments, buyers can be patient and selective. In others, decisiveness matters.

Understanding market context helps buyers avoid emotional whiplash. Without context, a fast sale feels like panic. A slow listing feels like failure. With context, both are simply data points.

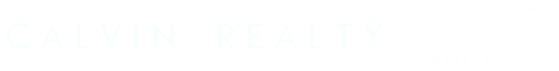

Market cycles exist. No market moves in a straight line. Buyers who understand where they are in the cycle tend to make calmer, more rational decisions.

Buyer’s Markets, Seller’s Markets, and Everything In Between

In a buyer-leaning market, inventory is higher, competition is lower, and negotiation leverage shifts toward buyers. Conditions are more common. Pricing flexibility increases.

In a seller-leaning market, inventory tightens, competition increases, and buyers often need to act decisively. Structure, timing, and clean offers matter more than perfection.

Balanced markets sit somewhere in the middle. These often produce the healthiest transactions — reasonable negotiations, fair pricing, and fewer extremes.

Understanding which environment you’re operating in helps set expectations. It doesn’t guarantee outcomes, but it prevents unrealistic assumptions.

Neighbourhoods, Location, and Long-Term Value

Two homes with similar layouts and price points can perform very differently over time based purely on location.

Neighbourhood fundamentals matter. Access to employment hubs, schools, transit, amenities, and future development all influence desirability. Buyers often focus on what a neighbourhood looks like today without considering where it’s heading.

Infrastructure investment, zoning changes, demographic shifts, and commercial development all shape long-term value. Buyers who understand these factors tend to make decisions that age well.

Location also impacts daily life. Noise, traffic patterns, walkability, community engagement, and proximity to essentials affect how a home feels long after the novelty wears off.

Choosing the Right Property Type

Different property types behave differently over time.

Single-family homes often offer flexibility, privacy, and land value, but come with higher maintenance responsibility. Condos provide lower entry points and simplified upkeep, but introduce condo boards, fees, rules, and document reviews. Townhomes and duplexes sit somewhere in between.

Each property type carries its own risk profile, maintenance expectations, and resale dynamics. What works well for one buyer may be completely wrong for another.

Understanding how a property type aligns with your goals, lifestyle, and tolerance for responsibility matters far more than aesthetics alone.

Searching With Intention Instead of Emotion

The search process becomes far more effective when buyers stop reacting to listings and start filtering opportunities through a clear framework.

The most common mistake buyers make is chasing perfection. No property checks every box. Strong buyers identify non-negotiables early and remain flexible on everything else.

Layout can often be modified. Finishes can be updated. Location fundamentals are much harder to change.

Search fatigue is real. Looking at too many homes without clear criteria leads to confusion, second-guessing, and emotional burnout. Intentional searching reduces stress and improves decision-making.

Pricing, Value, and What a Home Is Really Worth

Price and value are not the same thing.

A home’s list price reflects market strategy, not intrinsic worth. Value is influenced by recent comparable sales, condition, location, lot characteristics, and buyer demand.

Buyers who anchor emotionally to list price often overpay or miss strong opportunities. Buyers who understand context focus on relative value instead of absolute numbers.

Understanding why a property is priced the way it is helps buyers respond strategically rather than emotionally.

Writing a Strong Offer That Protects You

When the right opportunity appears, preparation shows up in the offer.

Price matters, but structure often matters just as much. Possession dates, deposits, conditions, and timelines all influence the strength of an offer.

In competitive situations, buyers who understand structure often outperform those who simply push price. Clean, thoughtful offers reduce friction and increase acceptance odds.

Strong offers protect buyers while respecting sellers. Aggression rarely produces the best outcomes. Clarity and reasonableness often do.

Negotiation: Creating Leverage Without Creating Conflict

Negotiation isn’t about winning or losing. It’s about creating an agreement that works while protecting your interests.

Emotional negotiation leads to overpaying, unnecessary concessions, or deal fatigue. Grounded negotiation relies on data, context, and calm decision-making.

Buyers who understand leverage — timing, market conditions, seller motivation — negotiate more effectively without creating unnecessary conflict.

Conditions, Due Diligence, and Risk Management

Conditions exist to protect buyers, not to complicate transactions.

Financing conditions ensure affordability. Inspections identify material issues. Condo document reviews uncover financial and governance risks. Property condition clauses protect buyers between acceptance and possession.

Skipping or waiving conditions without understanding risk can expose buyers to significant financial consequences. Due diligence isn’t pessimism. It’s preparation.

Buyers who complete thorough due diligence tend to feel confident moving forward. Buyers who skip steps often discover problems when it’s too late to address them.

The Final Walkthrough and Property Condition

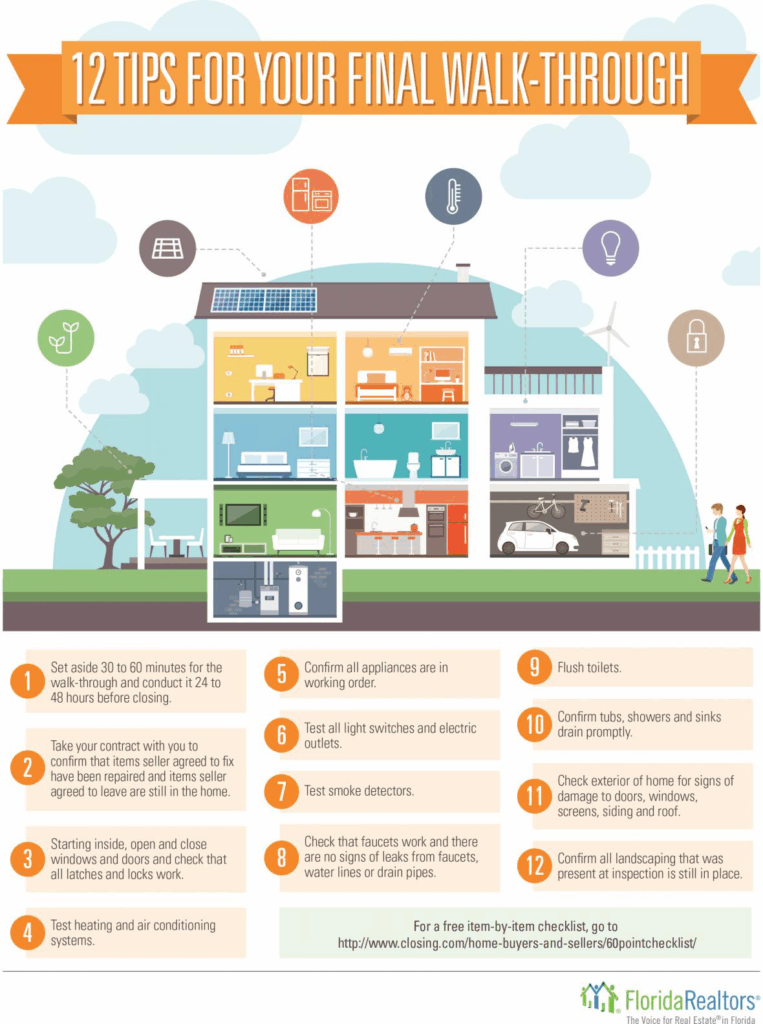

The final walkthrough is more than a formality. It’s your opportunity to confirm the property is in substantially the same condition as when you agreed to purchase it.

Damage, missing fixtures, or deferred maintenance discovered at this stage should be addressed before possession. Overlooking this step can result in inheriting problems that aren’t yours.

Attention here protects you at the most critical moment — just before ownership transfers.

Preparing for Possession and Ownership

The buying process doesn’t end when conditions are removed.

Preparing for possession includes understanding closing costs, insurance, utility transfers, service hookups, and move-in logistics. Many buyers underestimate how many details exist between firm deal and keys in hand.

Being organized during this phase reduces stress and prevents last-minute surprises.

The First Year of Ownership: Where Reality Sets In

The first year of ownership is where expectations meet reality.

Small repairs appear. Maintenance schedules become real. Utility costs fluctuate. This is normal.

Buyers who plan for this phase emotionally and financially adjust faster and enjoy ownership more. Buyers who expect perfection often feel disappointed, even when nothing is wrong.

Homes are living assets. They require care, attention, and patience.

Buying With Confidence, Not Pressure

The best real estate decisions are made with clarity, not urgency.

Pressure — from markets, timelines, or outside voices — leads to shortcuts. Confidence comes from understanding the process, your position, and your priorities.

When buyers feel informed, they move decisively without rushing and negotiate without fear.

Buying real estate is a meaningful milestone. Done well, it creates stability, opportunity, and long-term value. Done poorly, it creates stress and regret.

The difference is rarely luck. It’s preparation, perspective, and good guidance.