By Calvin Hexter, Calvin Realty/ Exp Realty

A view on what actually matters, who this business is really for, and why most people misunderstand it.

Table of Contents

Why I’m writing this

I didn’t get into multi‑family real estate because it sounded impressive. I got into it because, after years of watching single‑family transactions pile up, I started seeing the limits of trading time for commissions and the fragility of relying on one‑off deals. Edmonton has a way of humbling you if you don’t respect fundamentals. Cycles are real here. Cash flow matters here. Mistakes linger longer here than they do in hotter, more forgiving markets.

This article isn’t meant to hype commercial multi‑family or convince everyone they should be doing it. Quite the opposite. It’s meant to slow the conversation down and tell the truth about what this side of the business actually demands — from investors and from Realtors.

If you’re looking for a shortcut, this isn’t for you. If you’re curious about building something durable, repeatable, and intellectually honest in Edmonton’s market, keep reading.

What “commercial multi‑family” actually means in Edmonton

In theory, commercial multi‑family is simple: residential rental buildings with five or more units, valued primarily on income rather than comparable sales. In practice, the Edmonton market creates its own definitions.

Here, commercial multi‑family typically breaks into a few buckets:

- 5–8 unit walk‑ups often owned by long‑term local investors

- 10–30 unit buildings from the 1960s–1980s, usually wood‑frame, usually value‑add

- 30–100+ unit assets where professional management, debt structure, and operating efficiency start to dominate outcomes

Edmonton is not Toronto. We don’t have endless appreciation bailing out operational mistakes. We also don’t have Vancouver’s capital compression masking weak fundamentals. That’s a gift if you respect it — and a punishment if you don’t.

In this market, income quality, expense discipline, and location nuance matter more than storytelling.

Why Edmonton is a different animal

Anyone can read a national blog and talk about cap rates. Edmonton requires local fluency.

Some realities that shape everything here:

- Cyclical employment tied to energy, logistics, and construction

- Tenant profiles that skew blue‑collar, service‑based, and family‑oriented

- Rent ceilings that exist whether investors like them or not

- Wide neighbourhood variance — two areas five minutes apart can perform very differently

Edmonton rewards boring competence. You don’t win here by being clever. You win by being accurate.

I’ve seen investors import strategies that worked elsewhere and watch them bleed slowly. Wrong rent assumptions. Over‑renovating units past the tenant base. Underestimating management friction. Assuming exit liquidity that isn’t there.

Multi‑family here is a long game. That’s exactly why it works — for the right people.

How deals are actually evaluated (not how people say they are)

Everyone says multi‑family is about numbers. Fewer people are honest about which numbers actually move outcomes.

Net Operating Income is not a spreadsheet exercise

NOI is not theoretical. It’s behavioural.

- What rents can you actually collect, not advertise?

- How consistent is your rent roll?

- How disciplined is your expense control?

In Edmonton, expense creep is where deals quietly die. Utilities, maintenance, snow removal, management inefficiency — none of these are dramatic individually, but together they erase returns.

Cap rates are descriptive, not predictive

Cap rates tell you how the market views risk today. They don’t protect you from overpaying.

A lower cap rate in a better location may outperform a higher cap in a marginal area — but only if you understand tenant durability, not just neighbourhood reputation.

Financing shapes more than price

Debt structure in Canada — particularly CMHC‑insured options — changes behaviour.

Amortization length, interest rate risk, refinance assumptions, and covenant flexibility matter more than squeezing an extra half‑point on price.

Sophisticated investors don’t ask, “What’s the cap rate?” They ask, “What breaks first if assumptions are wrong?”

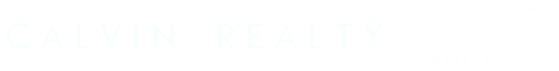

The asset classes inside multi‑family

Not all multi‑family is created equal. Edmonton makes this painfully clear.

C‑class value‑add walk‑ups

These dominate transaction volume. They’re misunderstood and often mismanaged.

Pros:

- Lower entry point

- Forced appreciation potential

- High demand tenant base

Cons:

- Management intensive

- Renovation fatigue risk

- Sensitive to municipal changes and bylaw enforcement

These buildings reward operators, not speculators.

B‑class stabilized assets

Often the most boring — and most resilient.

- Consistent tenant profiles

- Predictable maintenance

- Less dramatic upside, but fewer surprises

Many long‑term Edmonton investors quietly build wealth here without ever chasing headlines.

Larger scale assets

Once you cross certain unit thresholds, the business changes.

You’re no longer managing a building — you’re managing an organization.

- Professional property management is non‑negotiable

- Reporting cadence matters

- Capital planning becomes strategic, not reactive

This is where many small investors get stretched — and where disciplined teams thrive.

Risk looks different in multi‑family

The biggest risk in Edmonton multi‑family isn’t vacancy. It’s false confidence.

Common risk blind spots:

- Assuming rent growth without economic backing

- Underestimating tenant turnover costs

- Treating deferred maintenance as optional

- Over‑leveraging during stable periods

Multi‑family smooths volatility — it doesn’t eliminate it.

The best operators I know don’t chase max leverage. They chase sleep.

What separates good investors from frustrated ones

After watching hundreds of transactions, patterns emerge.

Strong investors tend to:

- Underwrite conservatively

- Choose boring neighbourhoods with durable demand

- Respect property management as a profession

- Focus on systems, not heroics

Struggling investors tend to:

- Fall in love with upside stories

- Assume they’ll “figure it out later”

- Optimize spreadsheets instead of operations

Multi‑family punishes ego quietly.

The Realtor’s role – and why most shouldn’t be here

This part matters.

Commercial multi‑family is not an add‑on skill. It’s a different discipline.

The Realtor is not just opening doors or negotiating price. They’re:

- Translating operational reality

- Pressure‑testing assumptions

- Managing investor psychology during long timelines

Most Realtors don’t fail here because they lack intelligence. They fail because they lack patience.

Deals take longer. Relationships matter more. Volume is lower, but depth is higher.

This work attracts Realtors who:

- Think in systems

- Enjoy nuance

- Are comfortable saying “this isn’t the right deal”

It repels those chasing fast wins.

Edmonton‑specific nuances Realtors must understand

You cannot fake local fluency.

Things that matter here:

- Neighbourhood‑level rent ceilings

- Proximity to transit and employment nodes

- Zoning and redevelopment pressure

- Municipal enforcement patterns

Clients don’t need hype. They need clarity.

Realtors who succeed here are translators, not cheerleaders.

How this business compounds

Multi‑family isn’t exciting year one. Or two.

It compounds quietly through:

- Stable cash flow

- Debt paydown

- Incremental operational improvements

The real payoff is optionality.

Investors who build portfolios here gain leverage in the best sense — control over time, risk, and future decisions.

Why alignment matters more than growth

At Calvin Realty, we learned early that not every Realtor should work with investors — and not every investor should be accepted as a client.

Alignment protects everyone.

When expectations are clear, outcomes improve.

This business is built on trust earned through competence, not persuasion.

The long view

Commercial multi‑family in Edmonton will never be glamorous. That’s why it works.

It rewards patience, discipline, and people who care about fundamentals.

For Realtors, it offers a path away from transactional burnout toward advisory relevance.

For investors, it offers durability in a world that increasingly lacks it.

This isn’t a pitch. It’s an invitation — to think deeper, work slower, and build something that lasts.

Those who resonate with that tend to find their way to the same conclusion, naturally.

Underwriting in the real world: where Edmonton deals actually succeed or fail

If there’s one place where people reveal whether they understand commercial multi-family or not, it’s underwriting. Not the spreadsheet itself — anyone can build one — but the assumptions behind it.

In Edmonton, underwriting isn’t about optimism. It’s about restraint.

Rent assumptions: ceilings are real here

Edmonton has rent ceilings, whether people want to admit it or not. They’re not published. They’re behavioural. They’re shaped by employment stability, household incomes, transit access, and the alternatives tenants have within a few kilometres.

I’ve seen too many deals fail quietly because someone assumed:

- Renovated units would automatically command top-of-market rents

- Tenants would absorb increases simply because costs went up

- What worked in another city would work here

Renovations don’t create demand. They only unlock it if demand already exists.

Strong underwriting in Edmonton starts with asking uncomfortable questions:

- Who is the actual tenant for this building?

- What are they earning?

- What choices do they have if rents rise?

Expense discipline matters more than upside

On paper, rent growth looks exciting. In reality, expense creep is what determines outcomes.

Utilities alone can swing NOI dramatically in older walk-ups. So can snow removal, emergency maintenance, insurance reassessments, and inefficient management structures.

Experienced investors don’t ask, “Can we raise rents?” They ask, “What breaks first if we don’t?”

Financing isn’t just leverage — it’s behaviour

CMHC-insured financing is a powerful tool, but it changes how people behave.

Long amortizations reduce monthly pressure, but they can also encourage complacency. Conservative investors use that breathing room to strengthen operations, not stretch assumptions.

The best Edmonton operators I know structure debt so that bad years are survivable, not so good years look impressive.

Property management: the silent determinant of returns

Most multi-family investors underestimate management. Not because they’re careless — because they’ve never lived through the consequences.

Self-management works until it doesn’t.

Usually the breaking point isn’t scale. It’s life. One health issue, one business distraction, one staffing problem — and suddenly vacancies linger, maintenance slips, and tenant quality erodes.

Third-party management isn’t a silver bullet either. Poor managers destroy value just as effectively as absentee owners.

Strong operators treat management as a core competency, whether internal or external.

They track:

- Response times

- Turnover costs

- Preventative maintenance

- Tenant retention patterns

They don’t wait for problems to appear in financials. By then, it’s too late.

Capital planning: why most “value-add” stories stall

Value-add is the most abused phrase in multi-family.

Real value-add isn’t cosmetic. It’s operational.

Yes, renovations matter — but only when they align with:

- Tenant expectations

- Neighbourhood norms

- Long-term maintenance strategy

Over-renovation is common in Edmonton. Investors spend money they can’t recover, chasing a tenant that doesn’t exist at scale.

The best improvements are often boring:

- Energy efficiency

- Mechanical reliability

- Layout functionality

These don’t show up on Instagram, but they show up in NOI.

Liquidity, exits, and the myth of the perfect sale

Edmonton is not a flip market for multi-family.

Liquidity exists, but it’s selective. Buyers are cautious. Financing conditions matter. Stories get tested.

Sophisticated investors plan exits they may never use.

They ask:

- Who would buy this asset?

- Under what conditions?

- With what financing?

If those answers aren’t clear, the deal isn’t as strong as it looks.

The Realtor’s role revisited: why fit matters more than skill

This work doesn’t reward surface-level competence.

Investor-focused Realtors must:

- Understand operations, not just pricing

- Manage expectations over long timelines

- Be comfortable slowing deals down

The best ones are calm under scrutiny. They don’t sell certainty. They offer clarity.

That’s not for everyone — and it shouldn’t be.

Why this attracts a certain kind of Realtor

Commercial multi-family attracts Realtors who:

- Think in systems

- Value depth over volume

- Want relevance ten years from now

It repels those chasing speed.

That’s healthy.

Where this leaves us

Edmonton multi-family is a discipline. Not a trend. Not a shortcut.

It rewards people who respect fundamentals, understand tradeoffs, and build patiently.

For Realtors, it offers a path away from transactional burnout toward advisory trust.

For investors, it offers durability in a volatile world.

People who take this work seriously tend to arrive at the same place — not because they were sold on it, but because it made sense.